Seven out of ten consumers say it is important for food and beverages to be 100% natural, according to the latest analysis conducted by FMCGurus on the clean label food market and recently published.

This is only a five percent decrease compared to the individuals who said this when the influence of the pandemic on health and safety and product choice was more evident. This highlights how consumers are more attentive to ingredient lists, wanting to avoid ingredients they consider harmful to their health and the broader environment.

Natural claims are associated with various benefits for individuals and the broader environment, which will encourage trade upwards in a recessionary environment.

The term natural is subjective and can be interpreted differently, meaning brands need to validate the claims made on packaging. After all, the basic principle driving demand for clean label products is the desire for maximum transparency regarding the origin and source of ingredients so people know the story behind the product.

Ultimately, naturalness is associated with reality and authenticity, with consumers wanting to avoid ingredients they consider artificial and chemical, which they feel lack nutritional value and can be harmful to themselves and the broader environment.

Additionally, consumers associate naturalness with recognizable ingredients, meaning the expression is synonymous with trust.

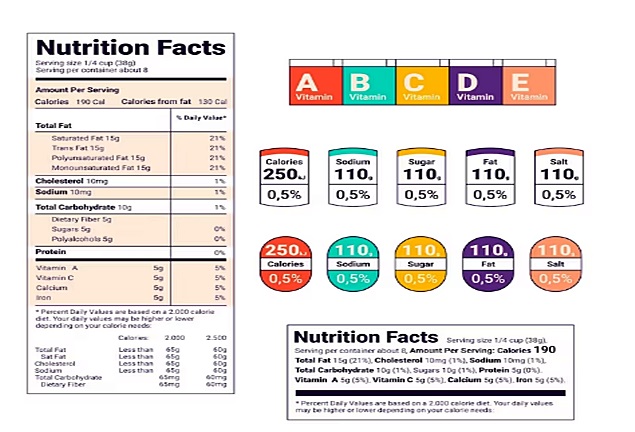

Consumers want to make informed decisions about the nutritional profile of products in a few seconds before deciding whether to buy a product or not. This means consumers embrace the notion of fewer ingredients being better, wanting to see simplified ingredient lists and various mentions without being cluttered on packaging.

Furthermore, plant-based and vegan-friendly claims will attract those following such dietary plans and those who consider such claims synonymous with purity. At the same time, it is essential for any product reformulation and ingredient rationalization to be associated with purity and something that enhances the quality of the products, as opposed to brands that remove vital ingredients as a cost-saving exercise at a time when raw material prices continue to rise.

Consumers are attentive to ingredient lists as they seek to improve their eating habits, avoid dietary evils, and seek assurance that maximum attention has been paid to product formulation.

At the same time, there has been a decrease in the proportion of people who believe nutritional labeling provides clarity and a significant increase in the proportion of people who believe such information could be further simplified.

As a result, nutritional labeling has less influence on food and beverage choices, indicating some distrust of labeling.

Consumers can sometimes be skeptical of brand practices and policies, often feeling they do not have their best interests at heart and may make misleading claims to command a premium price. In times of financial uncertainty, these feelings of skepticism tend to grow.

One example is that consumers may believe brands deliberately make nutritional labeling complex and confusing to conceal the use of certain ingredients in formulations. Significant cases of hidden sugar in products are something that has shaped these perceptions. Consumers may accept that a product is not the healthiest.

However, they are less accepting when they feel they have been misled about the nutritional profile of a product, meaning the industry needs to seek to adopt the notion of continuous improvement when it comes to simplifying product information on packaging. (Photo: Freepik)