2256

Following the publication of Law No. 141/2025 on fiscal-budgetary measures in the Official Gazette No. 699 of July 25, 2025, the Romanian Government is introducing a new VAT rate system, effective August 1, 2025, which will directly and significantly impact the food industry.

This fiscal reform redefines the applicable VAT rates across the agri-food chain and creates both opportunities and significant obligations for industry operators (processors, importers, retailers, distributors).

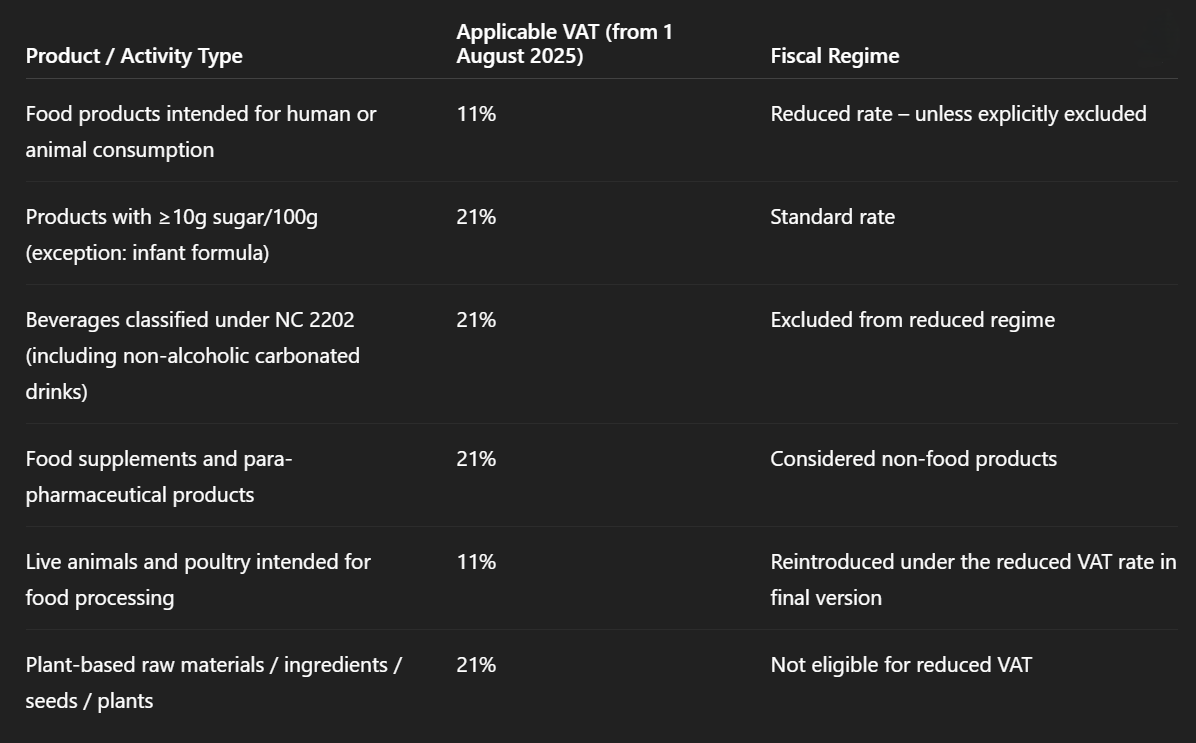

⚙️ Structure of the New VAT Rates in the Food Industry

📌 Essential Technical Notes

1. Application of the 11% VAT Rate – Definition and Conditions

The new reduced VAT rate of 11% applies to final food products (including bakery items, dairy products, canned goods, processed meats, etc.) only if:

- They are recognized as food according to applicable regulations (Regulation EC 178/2002),

- They do not contain excess sugar (≥10g/100g),

- They are not classified under NC 2202 (non-alcoholic beverages, juices, etc.),

- They are not food supplements, as defined by MS/ANPC legislation.

📌 Important: The interpretation of tariff classification is the direct responsibility of the taxpayer. In case of ANAF inspections, it is recommended to retain product sheets and NC classifications.

2. Reintroduction of Animal Raw Materials into the Reduced Rate

In the original version, live animals and birds were to be excluded from the reduced rate. However, following industry pressure, the Government explicitly included these categories in the 11% VAT annex, to ensure coherence in the agri-food supply chain.

📌 Eligible examples: live pigs for slaughter, poultry for processing, cattle, sheep, etc.

3. Plant-Based Raw Materials and Associated Risks

Ingredients such as grains, crude oils, seeds, medicinal plants, spices, or extracts remain excluded from the 11% VAT rate and will continue to be taxed at 21%.

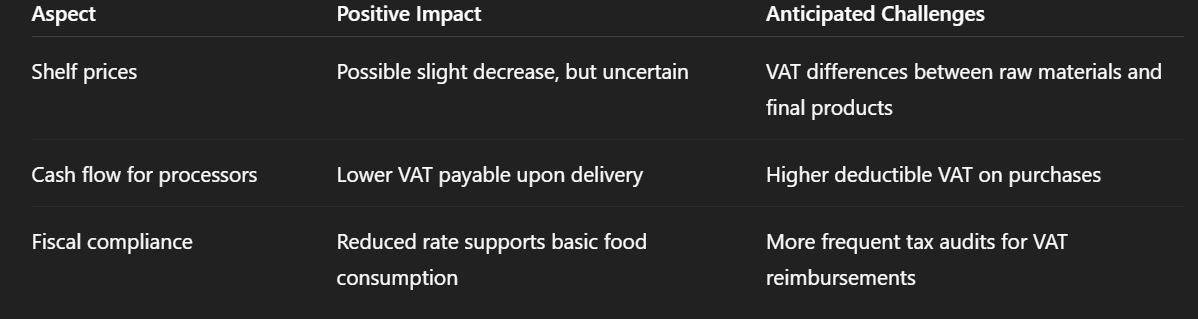

Direct consequences:

- Negative impact on cash flow for processors and producers,

- Potential recurring VAT refund claims,

- The need to adjust ERP systems for dual-rate application.

🔍 Tax Risks and Compliance Recommendations

🔸 Risks:

- Incorrect product classification → VAT adjustments and penalties,

- Lack of internal procedures to differentiate rates → non-compliance in declarations,

- Overlapping NC codes for mixed products → differing interpretations (ANAF vs. taxpayer).

🔸 Recommendations:

- Verify applicable NC codes for each product,

- Update ERP/accounting systems to reflect the new VAT structure,

- Train procurement, sales, and tax accounting personnel,

- Monitor the methodological guidelines promised by the Ministry of Finance in August.

📈 Economic Impact: Advantages and Challenges

✅ Conclusion

The food industry is entering a new fiscal era starting August 1, 2025, where internal VAT consistency, correct product classification, and adaptation of accounting systems will be essential. The reduced 11% rate, although seemingly beneficial, introduces a high level of fiscal complexity that requires a professional, well-documented, and preventive approach.

(Photo: Freepik)