1773

Apparent Stability in 2025, Followed by Major Transformations in 2026

The global dairy industry is going through a period of fragile balance. According to the report “Global Dairy Top 20: Subtle shifts for 2025, but a shake-up expected for 2026”, published by Rabobank in August 2025, the year 2025 will be marked by moderate adjustments and an apparent stability. However, these months conceal processes of consolidation and structural changes that will reshape the industry in 2026.

Global Dairy Top 20 Ranking in 2025

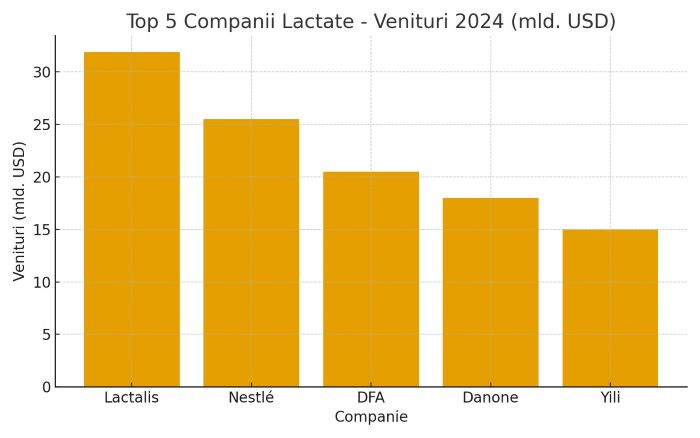

Lactalis (France) remains the global leader for the fourth consecutive year, with revenues of USD 31.9 billion in 2024. Recent acquisitions – including the Cremora brand (South Africa) and distributor Sequeira (Portugal) – strengthen the group’s position. Nestlé ranks second, while Dairy Farmers of America (DFA), affected by price volatility in the U.S., completes the podium.

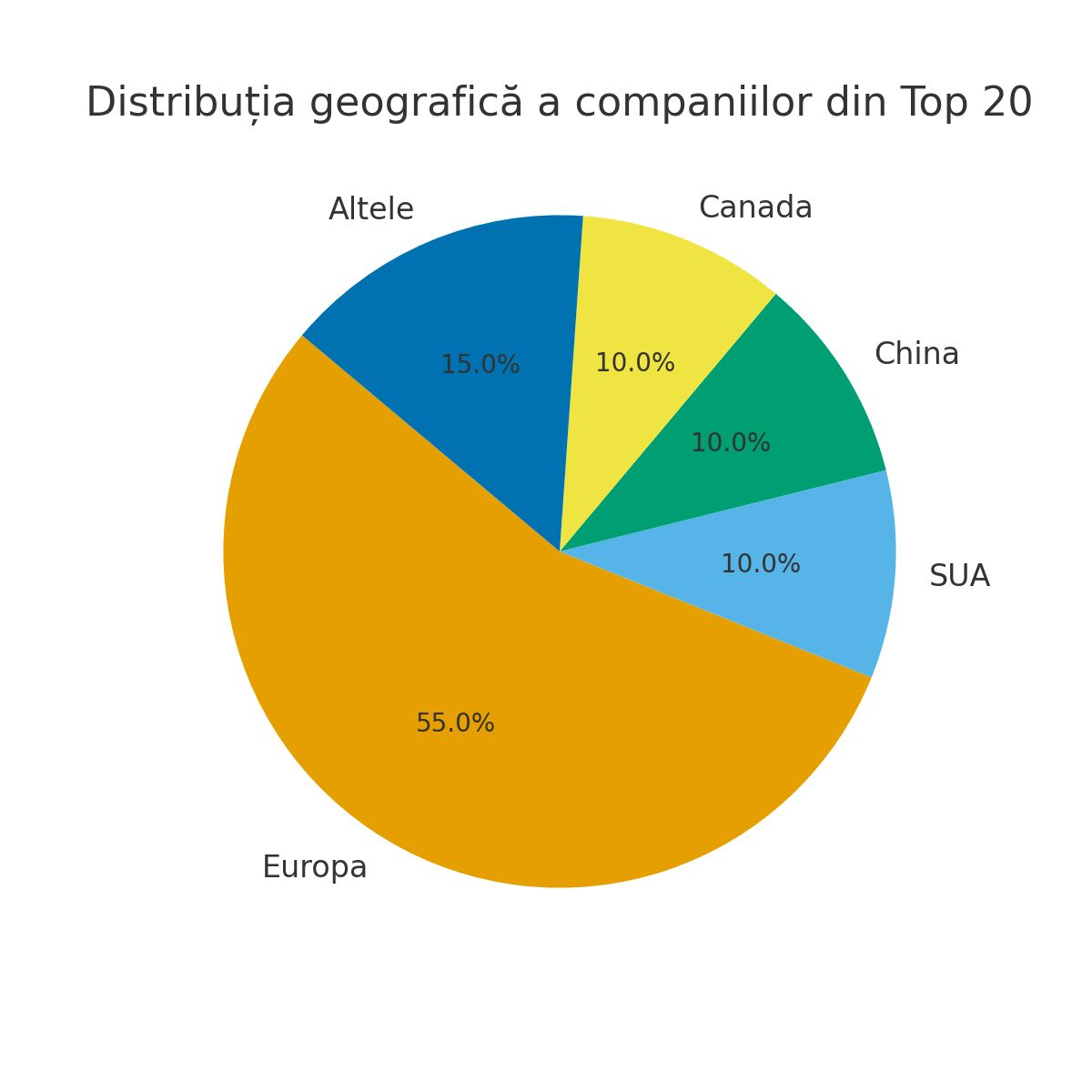

Danone (4th place) has undergone major strategic repositioning, selling assets in Russia, Belarus, and the U.S., but recorded a 4% increase in dairy revenues. Fonterra (New Zealand) has dropped to 7th place, and its divestment plans toward Lactalis could lead to a further decline. In contrast, Saputo (Canada) posted the fastest growth at +8.4%, surpassing Chinese company Mengniu. Europe remains the center of the industry, with 11 companies in the top, supported by strong currencies and solid infrastructure. Asia is facing overproduction and reduced demand, while China reported declines in liquid products and ice cream, whereas milk powder continues to be a growth driver.

2026: The Year of Major Restructuring

Rabobank warns that 2026 will bring a profound restructuring of the market. At least half of the companies in the Top 20 will undergo significant changes: the FrieslandCampina–Milcobel merger could create a top competitor in Northern Europe. Arla Foods could surpass Danone and climb to 4th place. The exit of DMK and Unilever from the ranking will open positions for new groups such as Emmi Group. The integration of Yoplait into Sodiaal and consolidations in the ice cream segment will reshape the European market.

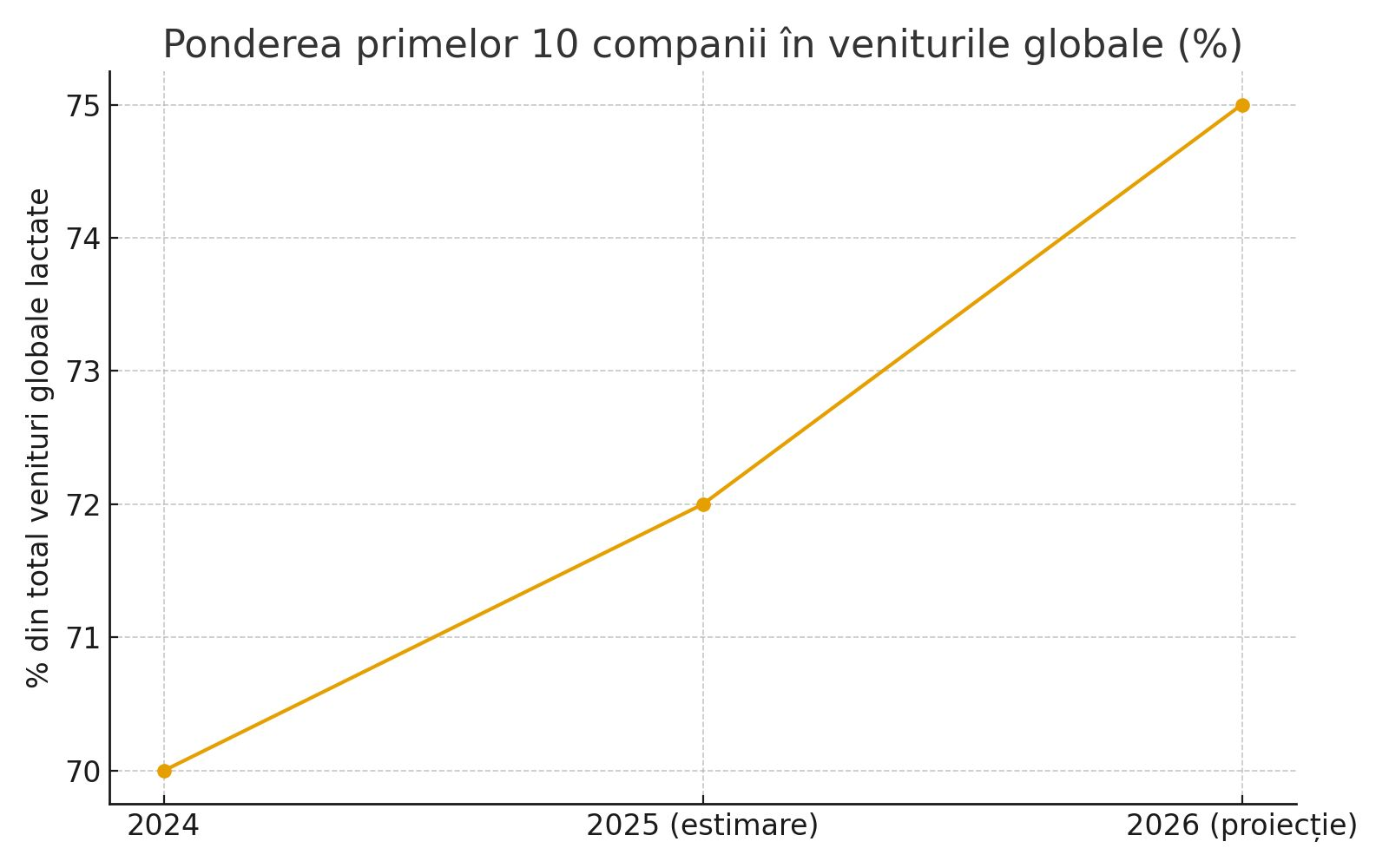

Rabobank’s analysis forecasts a polarization of the industry, with the top 10 players controlling up to 75% of global revenues by 2026.

Key Drivers

- Macroeconomic and currency fluctuations – The stability of the euro and the U.S. dollar provides an advantage for European and American companies, while the depreciation of the yuan affects competitiveness in Asia.

- Technology and digitalization – Automation in processing, traceability, and data analytics are becoming essential for cost reduction and efficiency gains.

- Demand for premium and sustainable products – The global market is shifting toward functional products and brands with added value.

- ESG pressures – Sustainability is becoming a prerequisite for access to financing and for strengthening reputation in developed markets.

Strategic Recommendations

Rabobank suggests using 2025 as a preparation period for the volatility expected in 2026: financial consolidation and investments in process efficiency, strategic planning including M&A scenarios, portfolio diversification through premium products, and investments in digitalization and ESG.

Conclusion

Rabobank’s report is more than an annual analysis: it is a strategic warning. The apparent calm of 2025 conceals transformative forces that will reshape the global dairy industry. Those prepared to invest and adapt will turn the volatility of 2026 into a competitive advantage.